As the saying goes…. “Don’t get into business with ANYONE without first defining how you’ll get out of ownership.” Starting a business or deciding to share ownership can seem straightforward initially. However, a critical aspect often overlooked is defining how each owner will eventually exit that ownership. After 50 years of working with business owners,Read More…

What’s Next? Defining Life After Transitioning Out of Business Ownership

Often when business owners think about transitioning out of business ownership, they focus on numbers and logistics first but don’t always consider what they will do after transitioning out of ownership. We’re talking about the big ‘what’s next?’ question that almost all of us face at some point in our careers, and the reaction businessRead More…

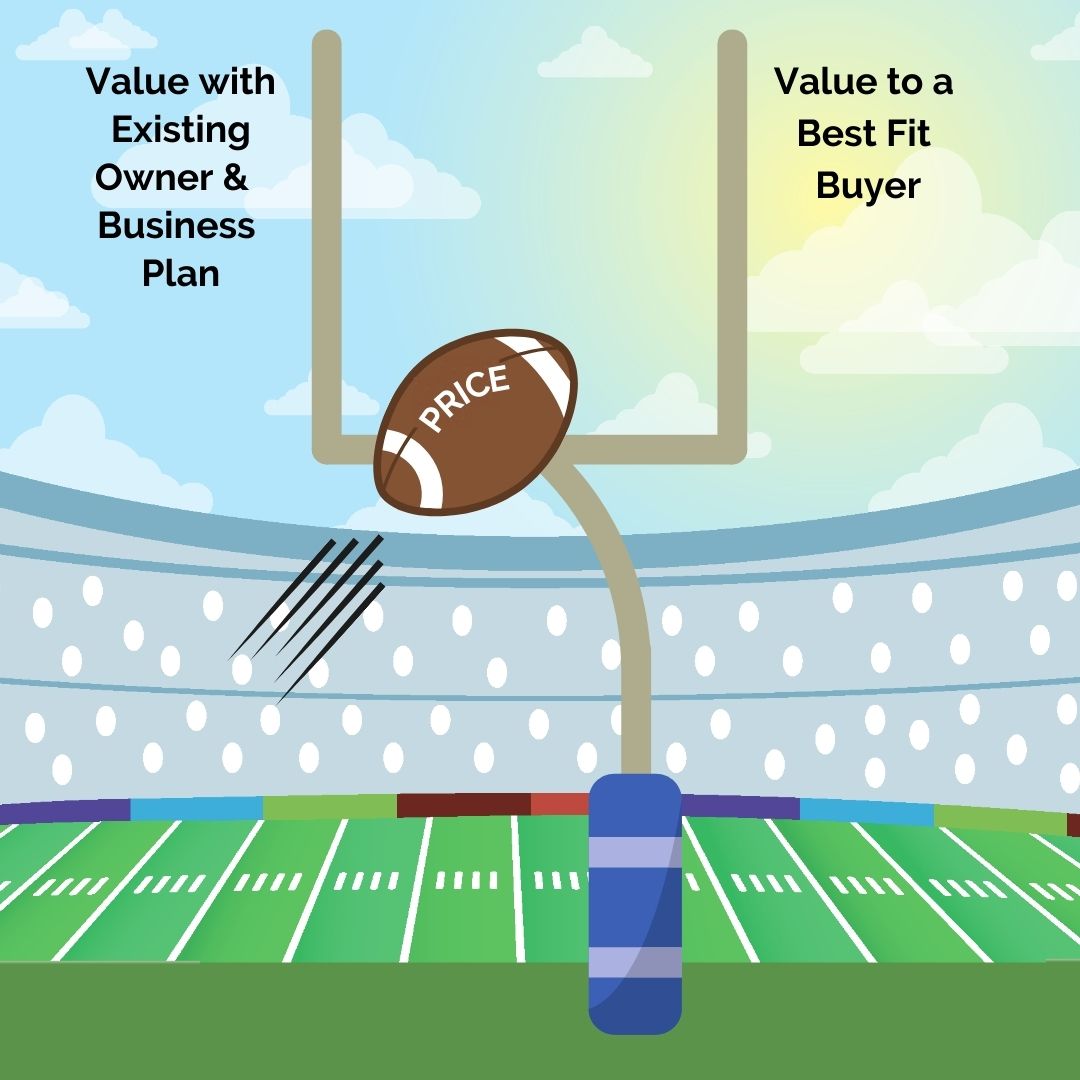

The Goal Posts of Business Value

Are you wondering what the value of your business is if you sold to a competitor or other type of “best fit” buyer, (i.e., buyer with a strategic interest in the acquisition of your business)? Different than selling to an inside employee group or passive investor, the sale of a business to a best fitRead More…

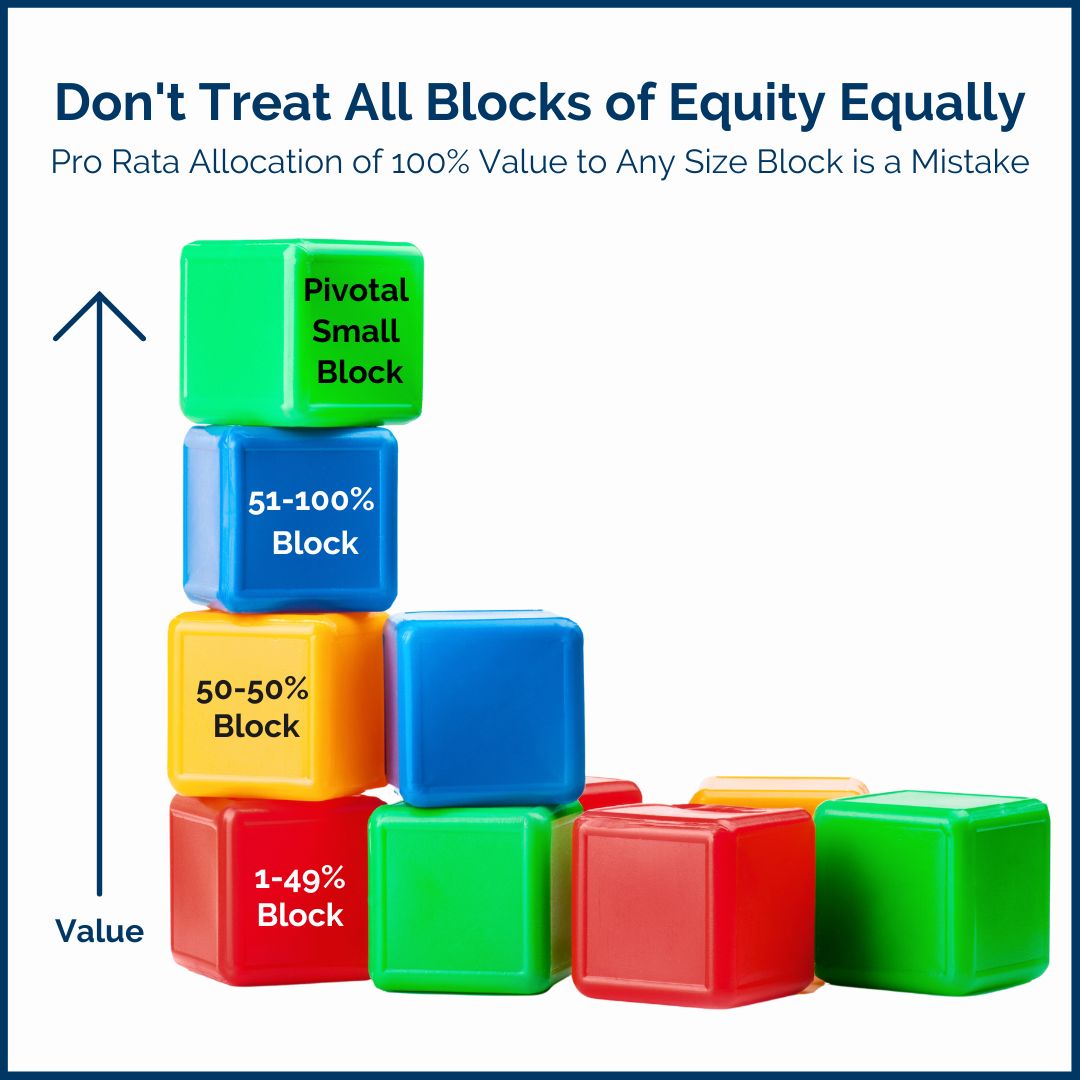

Avoiding a Frequent Mistake–Treating All Blocks of Equity (Ownership) Equally

Here’s a scenario we see occurring frequently: A 100% owner of a business wants to sell a 10% equity interest in their company to a key employee so they have some “skin in the game” and are less likely to leave and go elsewhere. Let’s assume the business owner has recently had a business valuationRead More…

The Power of Having Your Business Ready for Sale At Any Time

There is no shortage of new ideas and books each year on how to best manage your business. Most of these business management books are providing ideas which will ultimately (hopefully!) result in increasing the value of your business as an investment. In actuality, when done thoroughly, the business valuation process encompasses an analysis andRead More…

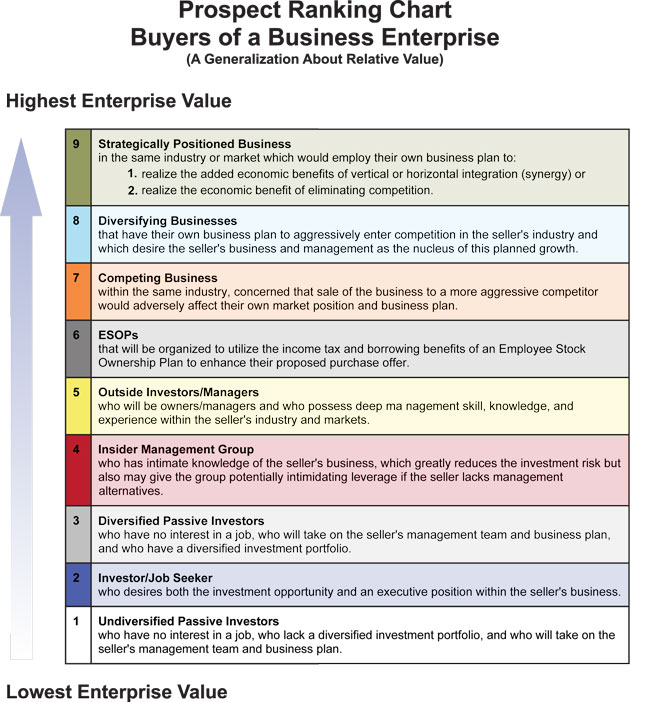

Selling to a Strategic Buyer

As you may have heard us say previously, every business has more than one value, depending upon who the buyer is. Different types of buyers are motivated differently based on what they could do with the business if they were to own it, as highlighted on our Buyer’s Chart. For example, some buyer types areRead More…

Goodwill—What is it and How is it Measured?

Goodwill, or ‘blue sky,’ is probably the most misunderstood component of business valuation. Business owners are often curious about goodwill in their business and how it is valued, and they are also often confused.In their minds, the intangibles including renown of the business, the years of successful business operation, their client list, their trained staff,Read More…

You have an interested buyer…now what? 3 Ways to be prepared.

Numerous clients have shared recently that they are seeing an increase in unsolicited inquiries about purchasing their business, some of which are legitimate inquiries from buyers or business brokers. While it is natural to be excited that you are a ‘target’ for an interested buyer, it is critical to slow down, stay calm and respond,Read More…

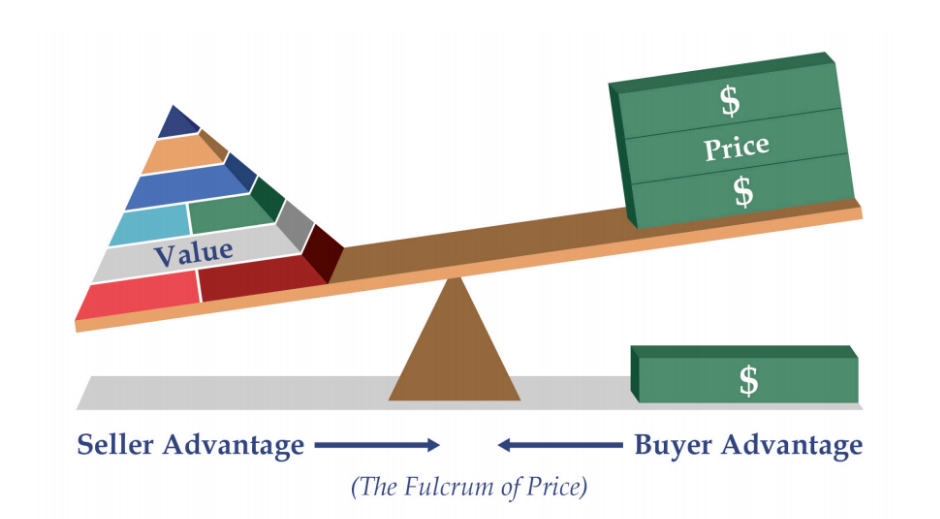

The Psychology of the Deal…Value Doesn’t Always Equal Price

Bargaining Position Matters. While they are frequently confused as being synonymous in the business world, the terms “value” and “price” don’t mean the same thing when it comes to business valuation. Every business ownership transfer involves negotiation, or bargaining, and bargaining position is a function of economic strength, knowledge, negotiating skills and timing. As such,Read More…

“I Wish I Had Known About this Earlier.”

We were recently working with a successful Wisconsin business owner who has been working on his succession plan. During our initial meeting he was surprised to learn that every business has more than one value depending upon who the buyer is. He lamented he had no knowledge or experience in thinking through the different typesRead More…