It’s often said that a business is worth whatever someone is willing to pay for it, so why should a business owner bother with a formal valuation, especially if they have no immediate plans to sell? After 50 years of valuing closely held businesses and assisting owners in preparing for ownership transitions, we’ve found thatRead More…

How to Build Value Today for a Future Exit

What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

Managing Your Business Like the Investment That It Is

And another year is in the books! It’s time to gather and review our bank statements, investment statements, tax statements…and if a business is owned, wrap up year-end accounting and journal entries to finalize financial statements. But some business owners are missing one critical year-end statement that can be a competitive differentiator…a reliable business valuation.Read More…

“It’s a Numbers Game” – Except for Healthcare and Business Valuation

I recently sat in a medical clinic waiting for a friend’s procedure to be completed when I came upon a New York Times article that stated it is our life expectancy, not just our age, that is increasingly figuring into calculations about whether certain medical screenings and treatments are appropriate. The crux of the articleRead More…

What is the Most Impactful Driver of Business Value?

We talk about the importance of understanding, increasing and unlocking the value of a business and while much of what we write and teach about relates to understanding how business valuation works, here we are focusing on increasing the value of a business. While there are many quantitative and qualitative levers that impact the valueRead More…

Does a business owner’s ability to delegate impact business valuation?

We often talk about the importance of a business owner working to make their business less dependent on them. Let’s face it, the entrepreneurial personality is frequently very self-driven, and enjoys controlling their own destiny. In the beginning, often the business IS the owner. The owner wears numerous hats and takes on the majority ofRead More…

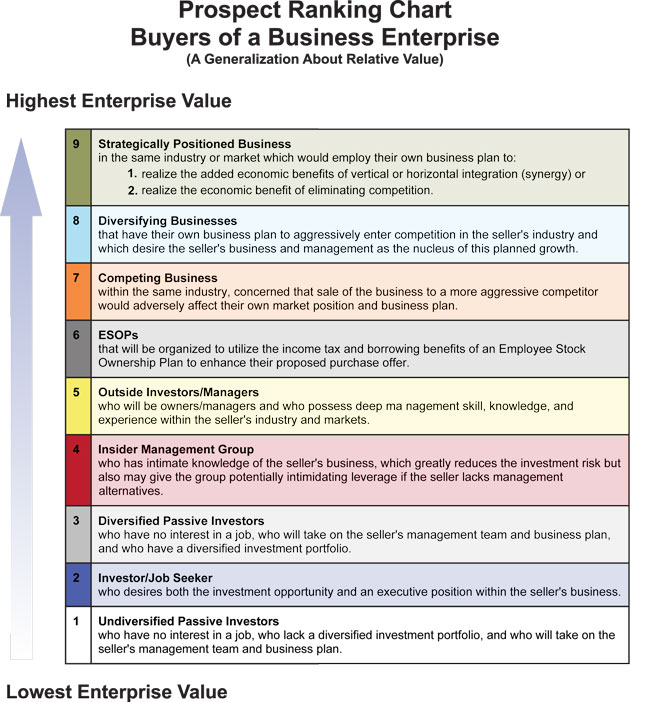

Selling to a Strategic Buyer

As you may have heard us say previously, every business has more than one value, depending upon who the buyer is. Different types of buyers are motivated differently based on what they could do with the business if they were to own it, as highlighted on our Buyer’s Chart. For example, some buyer types areRead More…

Isn’t Having a Large Customer A GOOD Thing?

You’ve heard that it’s risky to “put all of your eggs in one basket,” but did you know that the risk of having too few customers can actually translate into decreased business value How does Customer Concentration impact value? First, as a reminder, business valuation is based on both qualitative and quantitative factors that impactRead More…

Driving Workforce Engagement AND Business Value Through ESOPs

Having a trained, loyal workforce in place helps maintain a healthy, vibrant culture, which is considered an intangible asset in the world of business valuation. In fact, one of the 8 Key Value Drivers of a privately owned business is ‘Employees and Culture.’ In the simplest terms, a company whose team experiences low turnover andRead More…

Goodwill—What is it and How is it Measured?

Goodwill, or ‘blue sky,’ is probably the most misunderstood component of business valuation. Business owners are often curious about goodwill in their business and how it is valued, and they are also often confused.In their minds, the intangibles including renown of the business, the years of successful business operation, their client list, their trained staff,Read More…