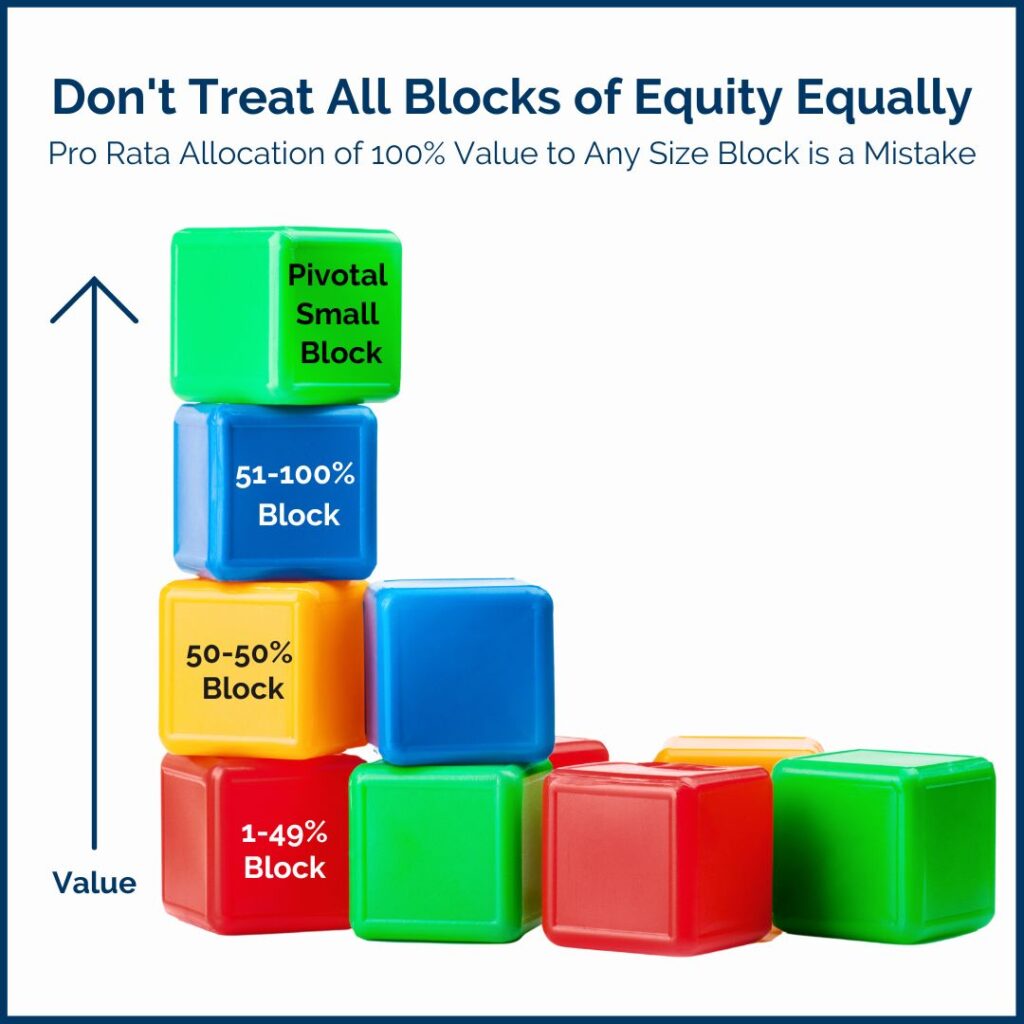

Here’s a scenario we see occurring frequently: A 100% owner of a business wants to sell a 10% equity interest in their company to a key employee so they have some “skin in the game” and are less likely to leave and go elsewhere. Let’s assume the business owner has recently had a business valuation for a 100% ownership interest completed for purposes of retirement planning. Can they simply allocate 10% of the business’s value as the selling price to any buyer? No, that would be a costly mistake. Let’s look at why.

Business appraisers frequently reference equity interests as “blocks of equity” or ownership interest. Whether the block of equity being appraised is considered to be a controlling block or a minority block of equity is critical to the value conclusion. Absent any agreements or contracts, a 51% or greater block of equity (i.e. controlling interest) is worth prorata the value of the business enterprise (100%); however, a 49% or lesser equity interest (i.e. minority interest) is NOT worth prorata the value of the business enterprise.

A controlling equity interest allows the owner of this block of equity to make decisions unilaterally that can directly affect the earnings and capital structure (amount of debt to have), assuming there are no factors and/or agreements to the contrary. An owner of a minority equity interest does not have the benefit of these same unilateral powers. Therefore, the minority block of equity needs to be accurately modeled and discounted during the valuation process.

Interestingly, equity interests of exactly 50% are common but unfortunately raise additional issues surrounding control. While the owner of a 50% block of equity lacks control to unilaterally impact or change the business, they do have veto power,or the power to say “no.” This too often leads to company stalemates and even dissolution, due to the disputes between the 50-50 shareholders or members.

Of course, the value of any block of equity also depends upon the number of other shareholders and the equity interests each of them holds. Here’s one extreme example: assume there are three owners of a business–two of which own a 49% equity interest and one that owns a 2% block of equity. In this situation, should the two 49% equity owners enter into a dispute of how to manage the business going forward, the 2% block of equity becomes a “pivotal” minority equity interest because the two 49% equity owners are then very interested buyers in the 2% block of equity. If the seller of the 2% block of equity understands the importance of this sale (giving the buyer a controlling block of equity of 51%) they would wisely demand a premium for what otherwise would be considered a minority block of equity. The buyer of this 2% block of equity gains the necessary control to take the business enterprise in the direction they choose.

What's Different Between a Controlling & Minority Equity Block?

When valuing a private business there are three key areas that are ‘normalized’ for a controlling block of equity that are not adjusted, or are adjusted differently, for a minority block of equity. These adjustments impact not only the future cash flows in the valuation but also the discount rates applied. These three areas that are treated differently include:

- 1. Operating and Executive Control: Ability to control the day-to-day operations as well as the strategic direction of the company.

- 2. Financial Control: Ability to determine the capital structure or mix of debt and equity for the company.

- 3. Liquidity Control: Ability to decide unilaterally when to sell.

Operating and Executive Control

If the business appraiser’s assignment is to determine the value of a controlling block of equity (51% or greater), they will look to make certain normalizations or adjustments to the historical financial data that would not be made if the assignment was to determine the value of a minority block of equity (49% or less). These adjustments frequently result in increased profitability/cash flows because certain discretionary expenses are adjusted to market or removed entirely. For example, an owner of a controlling block of equity can determine their own compensation levels, or the rent expense if they own the building/land in a separate, personally owned, entity. An outside buyer would adjust these items to market compensation or market rent to determine the cash flows that would be available to them as owners. In other words, they can purchase a controlling block of equity and then unilaterally make these decisions for themselves. If the buyer is purchasing a minority equity interest, they will not be able to make these changes without first finding agreement that such changes should be made. Therefore, the cash flows would not be greater. Common normalizations or adjustments made when valuing a controlling equity interest that are not made when valuing a minority equity interest may include:

- ● Adjustment of owner’s compensation to reflect current comparable market compensation (i.e., what would the owner be paid if they were fulfilling their current job description as an employee, not as an owner). This adjustment may reflect an excess or deficient compensation or perquisites.

- ● Adjustment of the company’s rent expense to market levels, if the rent is paid to the same individuals who own the operating business.

- ● Elimination of discretionary expenses and operating inefficiencies.

- ● Removal of transactions with family or other insiders whereby the Company is not receiving any real economic benefit.

- ● Applying a premium for executive control, or the ability for the controlling owner to impact the strategic direction of the company. For example, the decision to buy another business, name a board of directors, sell a business segment, etc.

Financial Control

Every business has two sources of capital: debt and equity. A dollar of debt used in the business has a far lower cost than a dollar of equity paid into, or left in, the business. Finance theory would teach us there is an ‘optimal mix’ of debt and equity depending upon the Company's industry. Financial control, or the decision as to the amount of debt a business carries, is unilaterally available to the controlling equity owner, but is not a unilateral decision available to the minority equity owner.

Liquidity Control

Another key difference in valuing a controlling versus a minority equity interest is the size of the discount for lack of marketability. Marketability speaks to the liquidity of the equity interest or how quickly and certainly can the equity be converted to cash at the owner’s discretion? This is compared to a publicly traded company equity holder who can obtain liquidity within 3 business days.

When considering marketability or liquidity of the private business, there are two components impacting the size of the discount.

- 1) First, can the owner unilaterally decide to sell the business? If one owns a controlling equity interest, the answer is yes, unless there is a legal agreement that dictates otherwise. The minority owner(s) would receive their share of the proceeds but cannot stop the sale from occurring or control this option to sell.

- 2) Secondly, assuming the valuation is of a controlling equity interest, while the owner of this block of equity can unilaterally decide to sell the business, surveys reveal that on average, it takes 6 months from listing to close on the sale of a privately owned business. The appraiser uses empirical data and judgment (as well as consideration of legal agreements in place between owners) in determining a reasonable discount for lack of marketability. In most cases, and again depending upon the terms of any legal agreements in existence between owners, the discount applied to a minority equity block is larger, often quite a bit larger. This is because not only does it take time to sell the business (and costs related to doing so) but they can’t even begin the process. A buyer of a minority equity block recognizes this will be the circumstances surrounding their purchase of a minority block of equity and would reasonably discount their offer to purchase.

Summary

The valuation of an equity interest in a business must be defined carefully at the start because the valuation exercise is quite different depending upon whether the question being asked is: “What is the value of a 50% or lesser equity interest?” or “What is the value of a 51% or greater equity interest?” Regardless of the equity interest being valued, a full understanding of the business, its future business plan and all the rights and restrictions defined in any legal documents between owners, is critical.

The key takeaway is that you do not value a minority equity interest in a company by simply allocating the value determined for a controlling equity interest. A controlling block of equity and a minority block of equity are apples and oranges from a valuation perspective.

See the Block Ranking Chart for further insight into the levels of control held by different blocks of equity.

If you have any questions about the business valuation process or the range of options available at CapVal, we welcome you to schedule a complimentary 1:1 session.

If you would like to discuss a specific business situation please reach out to us through our Contact page or call us at 608-257-2757 and we’ll connect you to a business valuation expert on our team.