What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

We Started Valuing Businesses Before Valuing Businesses Was Cool

We’re Celebrating 50 Years!

Look What’s Changed in 50 Years…

What surprises you most?

Discounts for Lack of Marketability—What are they and why are they needed?

Experienced business appraisers consider various factors when valuing a privately owned business, one of which is known as the discount for lack of marketability (DLOM). This discount for lack of marketability represents a deduction from the value of an ownership interest to reflect the limited marketability, or ease of sale, of a privately owned business.Read More…

How Has the General Economy Affected Business Value?

There are many day-to-day decisions that we as business owners control and can adjust for; however, one significant issue that is completely out of our control is the general economy. It’s interesting to reflect back over the past two years of business valuations our firm has completed and consider how the more recent economic changesRead More…

Managing Your Business Like the Investment That It Is

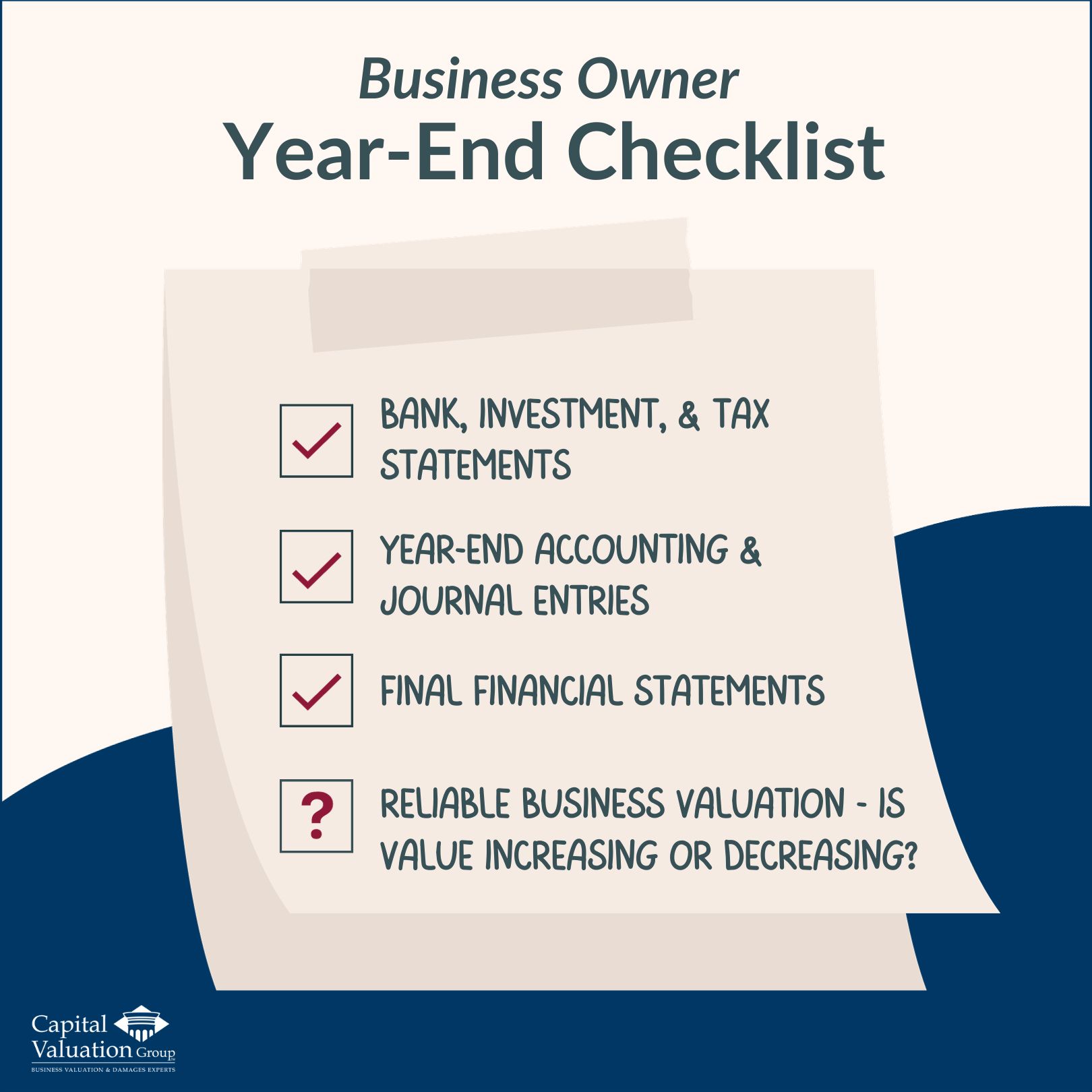

And another year is in the books! It’s time to gather and review our bank statements, investment statements, tax statements…and if a business is owned, wrap up year-end accounting and journal entries to finalize financial statements. But some business owners are missing one critical year-end statement that can be a competitive differentiator…a reliable business valuation.Read More…

Meaningful Business Valuation THRIVES on Complexity and Detail!

A business advisor recently mentioned that they were speaking with a business owner who wanted to plan for the future. The advisor suggested that it would be wise to have a formal business valuation done so that informed decisions could be made in the planning process. The owner responded that their business couldn’t be valuedRead More…

What’s Next? Defining Life After Transitioning Out of Business Ownership

Often when business owners think about transitioning out of business ownership, they focus on numbers and logistics first but don’t always consider what they will do after transitioning out of ownership. We’re talking about the big ‘what’s next?’ question that almost all of us face at some point in our careers, and the reaction businessRead More…

“It’s a Numbers Game” – Except for Healthcare and Business Valuation

I recently sat in a medical clinic waiting for a friend’s procedure to be completed when I came upon a New York Times article that stated it is our life expectancy, not just our age, that is increasingly figuring into calculations about whether certain medical screenings and treatments are appropriate. The crux of the articleRead More…

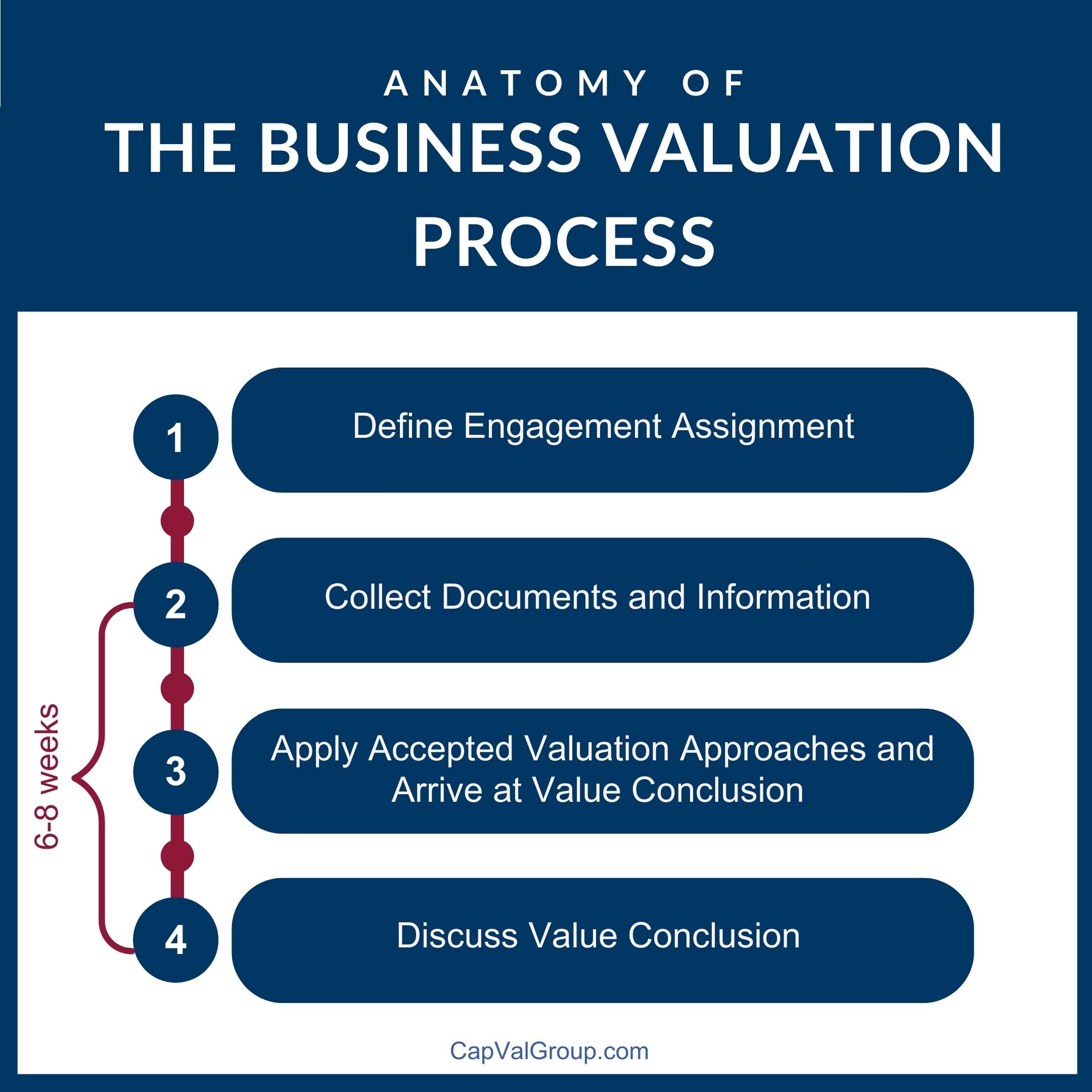

The Anatomy of a Business Valuation

Time for a business valuation? Here’s what to expect Business owners know their business better than anyone on the outside ever will. But when a business valuation is needed most owners have no idea what to expect. What information will be requested? How long it will take? What is the process? We work to makeRead More…

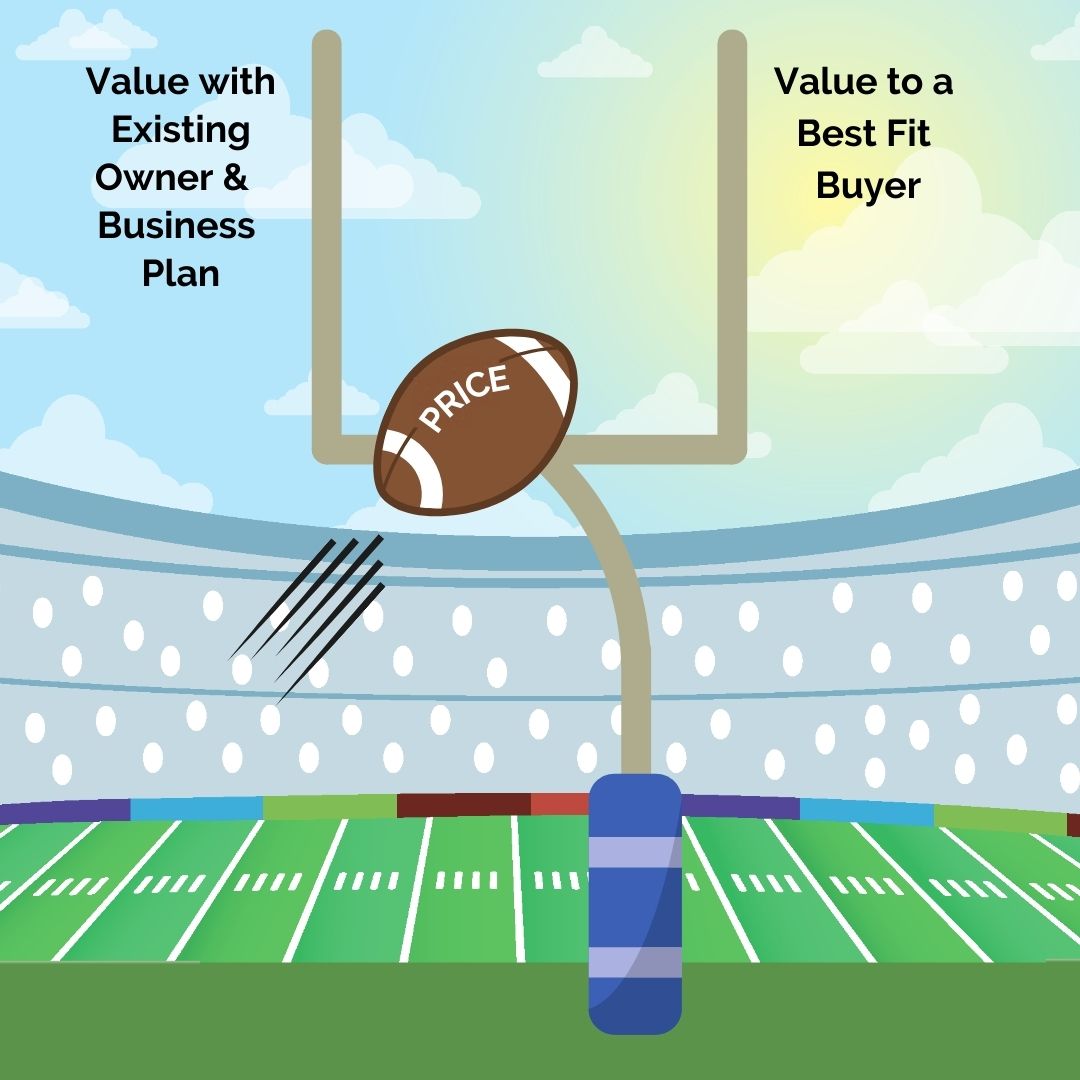

The Goal Posts of Business Value

Are you wondering what the value of your business is if you sold to a competitor or other type of “best fit” buyer, (i.e., buyer with a strategic interest in the acquisition of your business)? Different than selling to an inside employee group or passive investor, the sale of a business to a best fitRead More…