Bargaining Position Matters.

While they are frequently confused as being synonymous in the business world, the terms “value” and “price” don’t mean the same thing when it comes to business valuation. Every business ownership transfer involves negotiation, or bargaining, and bargaining position is a function of economic strength, knowledge, negotiating skills and timing. As such, the price actually paid for a business can be positively or negatively impacted by the seller’s actions in the time leading up to the sale.

The process of selling a business begins with identifying the value of the business, which is calculated based on expected future cash flows, and considers a combination of both quantitative and qualitative factors to reach that conclusion - not just a multiple of a number on a financial statement.

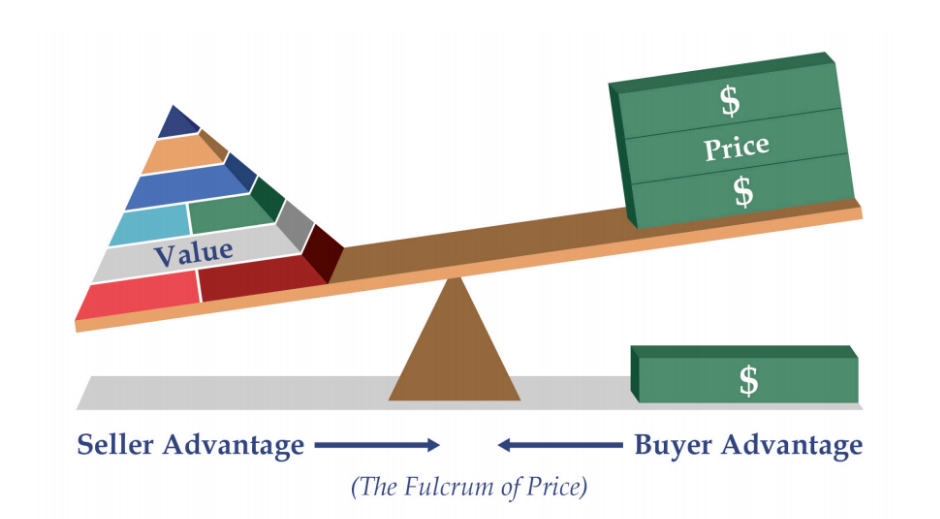

With a valuation as the starting point, then the negotiation between buyer and seller determines the transaction price and terms. It’s important to remember that when a business is sold, the buyer and seller rarely have equal bargaining positions. The complexity stems from the motivation to buy or sell, along with a number of other factors.

The seller is often at a disadvantage if the business enterprise must be sold due to an owner or key employee’s death, the business is no longer competitive, or the owner finds themselves in a hurry to retire but has not developed a plan for succession. In these situations, the buyer may acquire the business at a price well below its value since the seller does not have a strong bargaining position.

Alternatively, if the seller is not anxious to sell but the buyer is motivated to buy, the bargaining position moves to the seller’s benefit. Perhaps the buyer is interested in gaining a geographic footprint without having to build it, grow vertically or remove a competitor from the marketplace. In these situations, the buyer may well have to offer a price higher than the value of the company in order to motivate the owner to sell.

In summary, bargaining position impacts price; sometimes significantly. Having an exit strategy puts the fulcrum in your favor.

Key Takeaways:

- Market data or hearing the price of someone else’s business sale is interesting, but not an indication of value of another business.

- Price and value are not the same thing. Value is the starting point of the negotiation. Price is determined by whoever has the bargaining advantage.

- Having an exit strategy puts the fulcrum in your favor. Don’t wait until you’re in a hurry, or have no option but to sell, to start thinking about how to maximize value and price.

Action Items:

- If an interested buyer came knocking at your client’s door today, would they be ready? Review the 8 Drivers of Value, aka the qualitative and quantitative levers in a business that can be used to increase value, and help position them for maximizing price because they are planning ahead.

- Buyer motivations play a role in bargaining position. Did you know there are actually NINE types of buyers for any given business? This blog post was inspired by the comment we hear from new clients when they learn about the nine types of buyers. Familiarize yourself with the nine types of buyers in this blog post “I Wish I Had Known This Earlier.”

We’re always happy to answer any of your questions about how to help your client start planning ahead for a successful exit, whether or not they think they want to sell in the near future. It’s never too early to start planning ahead!

Cathy is the President of Capital Valuation Group, Inc., headquartered in Madison, WI. Capital Valuation Group has been helping business owners across the country understand, increase and unlock the value of their businesses for over 45 years through keynote speaking, valuation analysis, determining damages and providing expert witness testimony. Cathy welcomes conference and event speaking inquiries and can be reached at cdurham@capvalgroup.com.