Business Exit Strategy: Which Type of Buyer is Right for You?

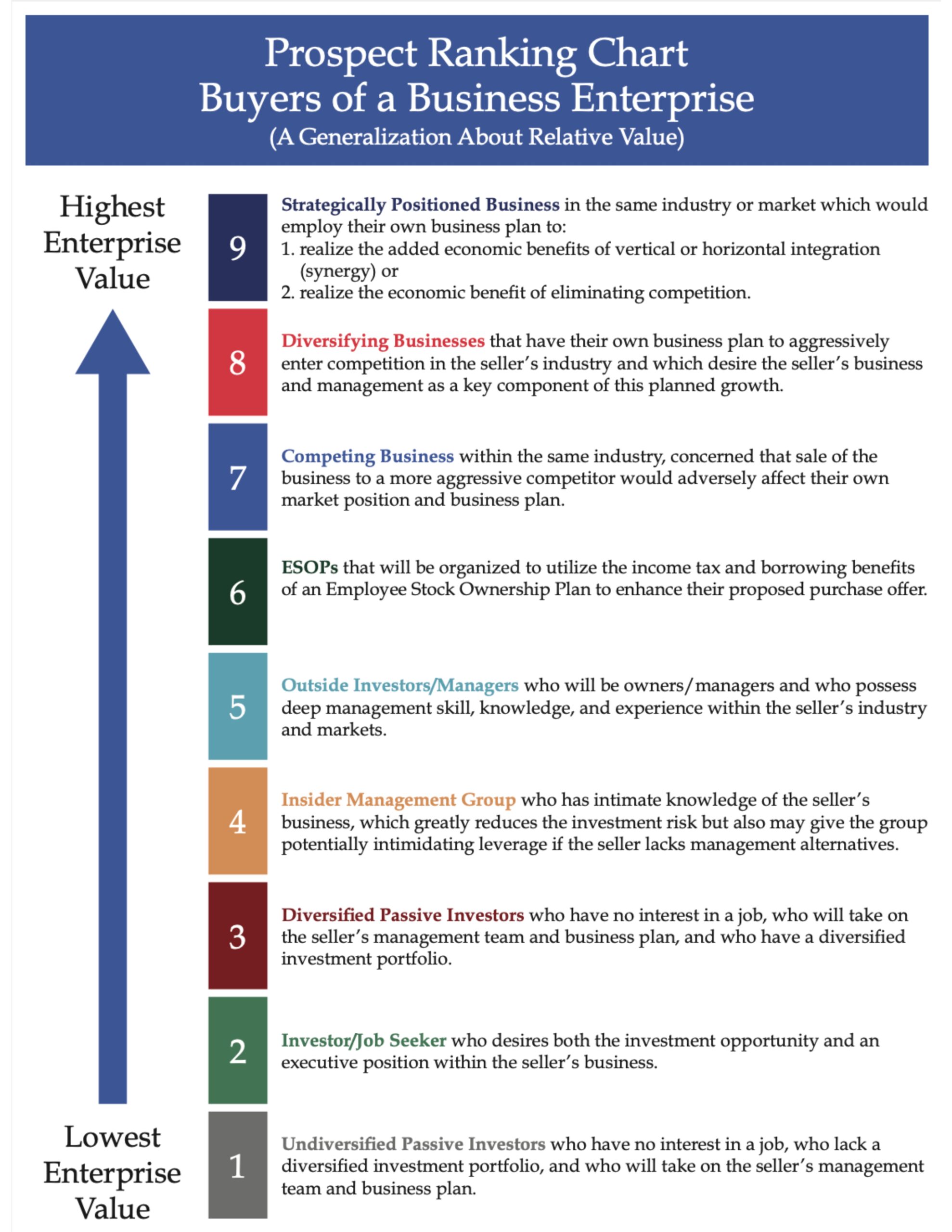

Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner. Generally, informed buyers calculate the value...

Prevent Lost Opportunity: Know the Value of Your Business

It’s often said that a business is worth whatever someone is willing to pay for it, so why should a business owner bother with a formal valuation, especially if they have no immediate plans to sell? After 50 years of valuing closely held businesses and...

Sharing Ownership With Key Employees—Will It Get You Where You Want to Be?

Business owners often consider sharing ownership with key employees for one of two primary reasons: 1. Ownership succession planning. 2. Increasing the likelihood that key employees will stay with the company. Initially, sharing ownership might seem like a wise, easy,...