Time for a business valuation? Here’s what to expect

Business owners know their business better than anyone on the outside ever will. But when a business valuation is needed most owners have no idea what to expect. What information will be requested? How long it will take? What is the process? We work to make our process as transparent as possible, so let’s look at the valuation process and documents that are needed when having your business valued with Capital Valuation Group.

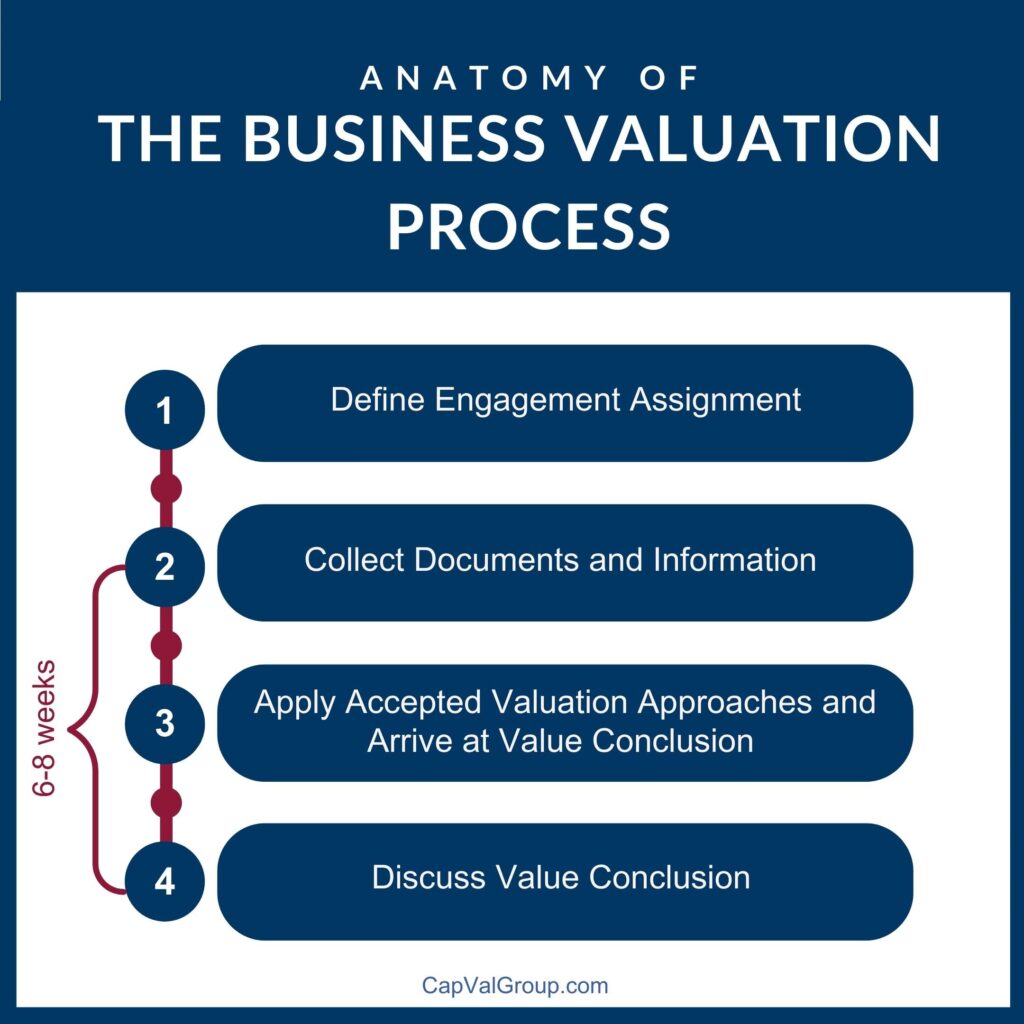

There are four phases to our work that help business owners know what to expect along the way. First we will define the engagement, then collect documents and information that help us gain an understanding of the whole business. Next, we’ll conduct a meeting(s) with the owner(s) to discuss the company's history, as well as the future business plan. After the analysis is complete we will discuss the valuation conclusion. Here is an expanded view of each of the four key steps:

Step 1 - Define Engagement Assignment

First, we will be interested in key information that will be needed to define the engagement. These include:

- Why is the valuation needed? How will it be used? For internal planning? Internal management? Potential sale? Potential purchase? Estate tax filing? Gift tax filing? Divorce? or Other?

- What is the equity interest to be valued? 100%? 50% block? 25% block? Or another percentage?

- What is the “as of” date for the valuation? For most of our clients, this is the previous year end, but depending upon the purpose and/or time of year, it can be any time during the year. And yes, this 'as of' date can potentially make a significant difference in some scenarios.

- Who will be engaging us? Sometimes it is the business owner, but it can also be their attorney or other business advisor.

- What end product is needed as a deliverable? A summary written report, a fully documented written report, or a verbal discussion?

Once we know the answers to these questions we provide an engagement letter that defines the assignment and includes a fee estimate (or many times a fixed fee) for the defined services. The client reviews and signs the engagement letter which gives us the green light to proceed.

Step 2 - Collect Documents and Information

The engagement letter also provides the client with instructions for how to access our document request. This is a complete listing of the documents and information we need to proceed. Reaching a reliable value conclusion requires the appraiser to understand not only the historical financial information (quantitative information) but all the other qualitative factors that can impact value (see below). Generally, the documents requested include the following:

- Five years of historical, year-end financial statements

- Five years of business tax returns

- Organizational documents relating to the owners of the business and the equity interest owned by each. Also any agreements among the owners that would enhance or restrict the transfer of an ownership interest. These types of documents are typically called buy/sell agreements, operating agreements or shareholder agreements.

- Agreements granting anyone options or rights in the company’s equity

- Information enabling the appraiser to consider the qualitative factors in the business

- Listing of competitors

- Listing of top 5 customers (this information can be reported without disclosing the actual company/client names) to understand any potential customer concentration issues (ie risk of putting all your eggs in one basket)

- Listing of top 5 vendors/suppliers to understand any potential supplier concentration issues

- Organizational chart to gain an understanding of management depth, employee turnover and culture

- Copies of leases for facilities and recent tax assessments

- Summary of intangible assets owned (such as patents, copyrights, etc.)

- Listing of any contingent liabilities such as ongoing litigation, environmental issues, etc.

Step 3 - Apply Accepted Valuation Approaches and Arriving at Value Conclusion

Once this information is received and reviewed, we will prepare a summary of the five years of historical financial statements and schedule the first meeting with the owner(s). At this meeting, we will ask questions to gain an understanding of the history of the business and key milestones; including reviewing the historical financial trends of the business and covering any questions that arise from this financial summary. The balance of the initial meeting is focused on looking forward and involves gaining an understanding of where the business is going, as well as a discussion of the risks and opportunities facing the business.

Together, the business owner(s) and our team develop assumptions to be used in preparing projections for the company to be used in one of the three business valuation approaches we use to calculate our value conclusion–the income approach. We review these projections with the owners to confirm the projections accurately reflect the company’s ongoing, future business plan.

Behind the scenes, we are researching the industry and general economy as well as identifying comparable transactions to gather transaction data to be applied to the subject Company; which is using the second of three valuation approaches–the market approach. Note: The third valuation approach we consider is the asset approach, which assumes the assets would be sold piecemeal. This requires that the individual assets be restated to their respective market values. The asset approach rarely applies (except for very asset-intensive businesses), as most businesses put their assets to work to generate cash flows that make the business more valuable than the combined liquidation value of the assets. These are the cash flows measured in the income approach noted earlier.

We consider industry and market conditions, as well as the overall risks the business faces to determine supportable discounts for calculating the present value of the projected cash flows and discounts for lack of marketability that apply to all privately owned businesses.

Step 4 - Discuss Value Conclusion

Typically, within 6 to 8 weeks from receiving all the requested documents, the value conclusion is reached and shared with the owner(s) at a meeting and/or through a written report. This thorough yet expedient process is possible because our boutique firm focuses entirely on business valuation and litigation support, day in and day out. We have been doing this work and defending our conclusions for nearly a half century, and have learned along the way that shortcuts don’t work, but good processes, thorough analysis, and continuous client communication do work. AND, we realize you don’t have months to wait!

As you can see, our four-step process is far more involved than simply taking a single earnings number from the income statement and applying a multiple. Using this shortcut is 100% focused on the past financial results of the company, assumes NO change in the future performance, and ignores all the qualitative factors that make each privately owned business unique. Interestingly, it's these qualitative factors that often make one business more (or less) valuable than another in the same industry.

After nearly 50 years of specializing in business valuation, we can confidently say that once you have valued a closely held business, you have valued just one business. Even businesses in the same industry can differ greatly based on the operating model the owner(s) have chosen to follow.

Have questions about your unique business situation?

Please reach out with questions about what you can expect when working with our team on a business valuation project, or business valuation in general. We want to hear your questions!

If you would like to discuss a specific business situation please reach out to us through our Contact page or call us at 608-257-2757 and one of us would be happy to talk through your situation.