The Story Behind the Numbers

Value Added Ideas For Business Owners and Their Advisors

The Anatomy of a Business Valuation

|

Time for a business valuation? Here’s what to expect Business owners know their business better than anyone on the outside ever will. But when a business valuation is needed most owners have no idea what to expect. What information will be requested? How long it will take? What is the process? We work to makeRead More… |

The Goal Posts of Business Value

|

Are you wondering what the value of your business is if you sold to a competitor or other type of “best fit” buyer, (i.e., buyer with a strategic interest in the acquisition of your business)? Different than selling to an inside employee group or passive investor, the sale of a business to a best fitRead More… |

Exit Planning is Simply Good Business Planning

|

We have to start thinking positively about the words “exit planning.” You say the words, and owners shut down – could be because of emotional attachment, the fear of change, lack of resources…. Could be worse – could be lack of awareness or procrastination. But guess what? Studies have shown that 75% of those whoRead More… |

What is the Most Impactful Driver of Business Value?

|

We talk about the importance of understanding, increasing and unlocking the value of a business and while much of what we write and teach about relates to understanding how business valuation works, here we are focusing on increasing the value of a business. While there are many quantitative and qualitative levers that impact the valueRead More… |

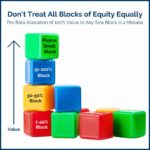

Avoiding a Frequent Mistake–Treating All Blocks of Equity (Ownership) Equally

|

Here’s a scenario we see occurring frequently: A 100% owner of a business wants to sell a 10% equity interest in their company to a key employee so they have some “skin in the game” and are less likely to leave and go elsewhere. Let’s assume the business owner has recently had a business valuationRead More… |

Business Valuation is More Than a Multiplication Equation

|

The risk of rushing to democratize business valuation The importance of business owners understanding the value of their business cannot be understated. Far too many business owners believe that a business valuation is not needed unless selling is imminent. This thinking stunts the owner’s ability to manage their business as an investment—to know with certaintyRead More… |

Capital Valuation Strengthens Our Team as Marty Mathias Becomes Shareholder

|

Since CapVal was founded in 1974, we have made it our goal to maintain a team of professionals who have expertise in a variety of cross functional topics. Our founders discovered that different training, education, and experience leads each of us to approach the business valuation process from different perspectives. A business valuation or damagesRead More… |

The Power of Having Your Business Ready for Sale At Any Time

|

There is no shortage of new ideas and books each year on how to best manage your business. Most of these business management books are providing ideas which will ultimately (hopefully!) result in increasing the value of your business as an investment. In actuality, when done thoroughly, the business valuation process encompasses an analysis andRead More… |

Does a business owner’s ability to delegate impact business valuation?

|

We often talk about the importance of a business owner working to make their business less dependent on them. Let’s face it, the entrepreneurial personality is frequently very self-driven, and enjoys controlling their own destiny. In the beginning, often the business IS the owner. The owner wears numerous hats and takes on the majority ofRead More… |

Are you looking for an online business valuation tool to determine a reliable value for business planning?

|

When talking with business owners and/or their advisors it is common for us to hear that the process of working together came to a halt when it was time to enter a value for their business. Business owners almost always have a good idea of the value of their home, investments, boat, car or otherRead More… |

← Older posts Newer posts →