What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

Discounts for Lack of Marketability—What are they and why are they needed?

Experienced business appraisers consider various factors when valuing a privately owned business, one of which is known as the discount for lack of marketability (DLOM). This discount for lack of marketability represents a deduction from the value of an ownership interest to reflect the limited marketability, or ease of sale, of a privately owned business.Read More…

How Has the General Economy Affected Business Value?

There are many day-to-day decisions that we as business owners control and can adjust for; however, one significant issue that is completely out of our control is the general economy. It’s interesting to reflect back over the past two years of business valuations our firm has completed and consider how the more recent economic changesRead More…

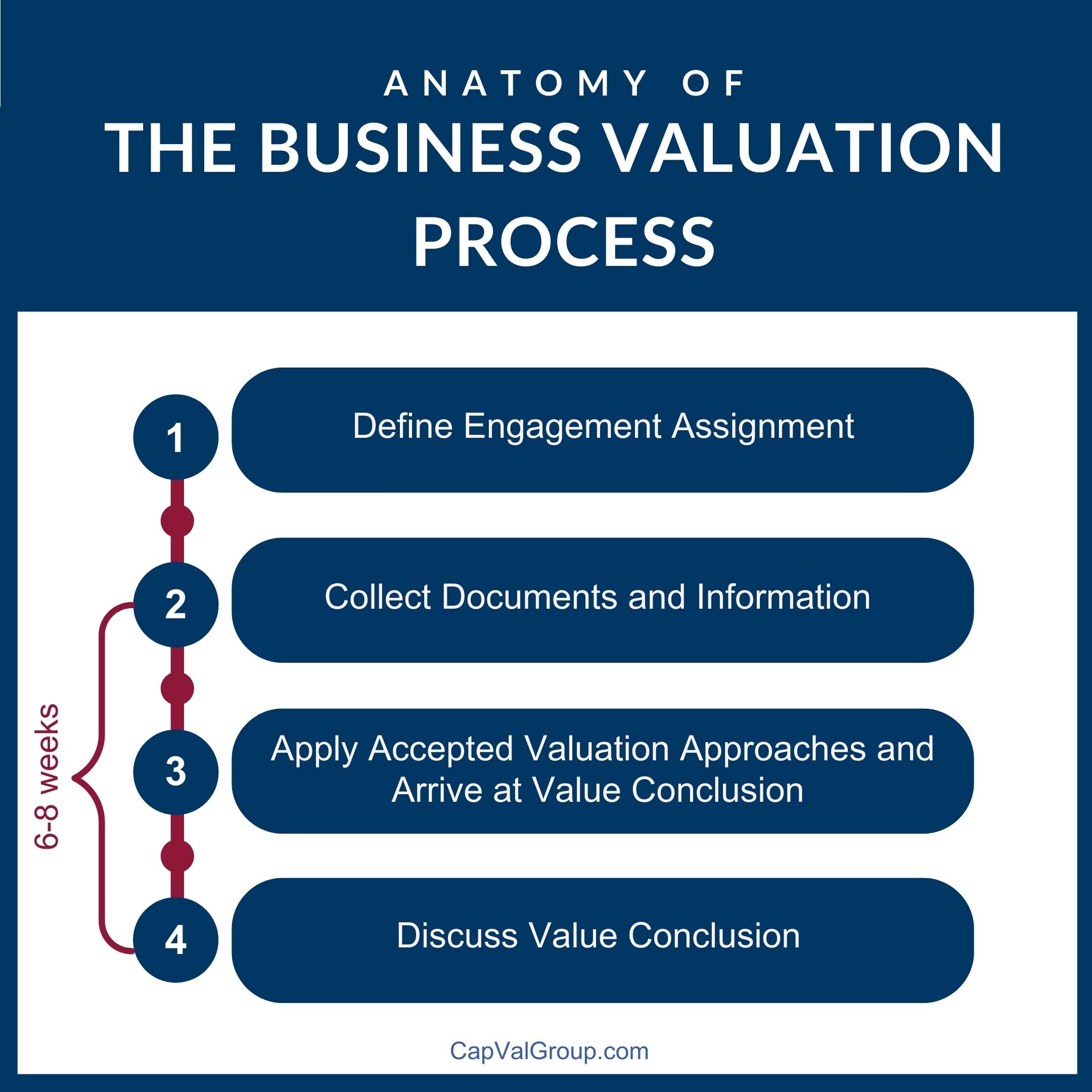

The Anatomy of a Business Valuation

Time for a business valuation? Here’s what to expect Business owners know their business better than anyone on the outside ever will. But when a business valuation is needed most owners have no idea what to expect. What information will be requested? How long it will take? What is the process? We work to makeRead More…