|

Something notable happened with many business owners while managing through COVID that could impact the value of their businesses. It doesn’t have anything to do with their financials, and it doesn’t get much attention in the news.

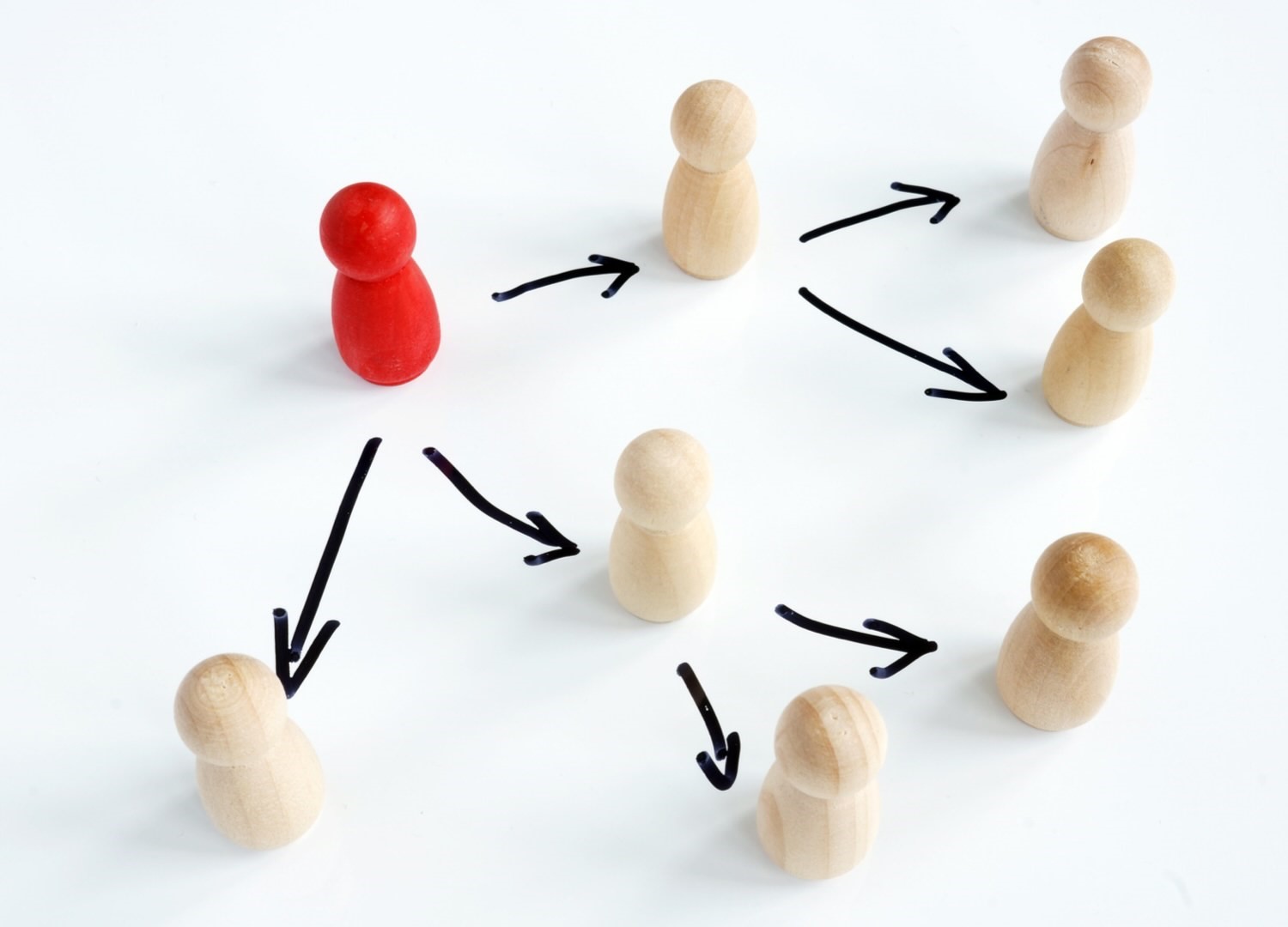

We’re talking about delegation. Many business owners responded to COVID by putting delegation of business operation decisions and key responsibilities on hold and reclaimed control of business operations. |

Sure, you hear it’s important for a leader to delegate responsibilities and decision making for a variety of reasons, but not many people know that this is a key qualitative factor that is considered by experienced business valuation experts when determining the value of a privately owned business.

As is natural in the face of an unexpected crisis, many business owners paused in the early days of the COVID pandemic as they took stock of the situation and determined next steps. Delegation under normal circumstances tends to be difficult for the entrepreneur, and even more so when it’s a family business passing the reins to the next generation.

Instead of preparing for the long-term future, the focus quickly becomes short-term. Will the phones keep ringing? How can we keep customers and employees safe? Will our banker call our line of credit? Will employees be available to work?

Whether protection mode is initially seen as the right solution for the health of the business, the peace of mind of the team, or shielding the next generation from the stress of taking on leadership during a pandemic, it’s important to recognize these moves can actually be doing more harm than good in some cases.

As the initial shock of the pandemic lifts and leaders shift back to planning for the future again, it’s time to check in on the topic of delegation. To avoid disheartening and discouraging future leaders in the business, current owners need to TRULY delegate. This means areas where the owner would have made decisions in the past need to be handed off, not pulled back in. There will be future crises, guaranteed, so learning to make decisions under stress is a critical learning opportunity for the next generation of owners. Having the opportunity to do this while the existing owner(s) is still available as a mentor and coach is incalculable.

Why is delegation so important?

We have shared in the past that the reason multiples and rules of thumb don’t work in business valuation for privately held businesses is because this “math” implies every business is the same qualitatively. Yet we know no two privately held businesses are alike, even if they exist in the same industry. There is a complex mix of both quantitative AND qualitative factors that must be considered. We list 8 of these factors here, but one of those qualitative factors is the topic of owner dependency. In other words, how dependent is the business on the owner in order to keep running successfully?

One “test” of owner dependency is whether the owner could leave the business for 3 to 4 weeks without having a significant negative impact to the business.

If the owner has successfully built a company where processes are in place and responsibilities are confidently borne by others within the company, value actually increases. Why? Because this increases the likelihood of the next owner (whether internal or external) transitioning successfully and reduces risk. For example, relationships with vendors and customers are more likely to continue, and employees are more likely to stay with the company and remain motivated. In short, the business is positioned for a more seamless transition.

There’s another factor at play here as well. 70% of all businesses today are owned by baby boomers (born between 1946 and 1964) and they are retiring at the rate of 10,000/day. So most businesses today are owned by these boomers and it is a generation of owners who have a reputation for having a more difficult time delegating. It typically just doesn’t come as naturally and it’s something we coach boomer business owner clients on regularly.

For those who were working on delegation, the pandemic was certainly unexpected and we’re seeing that it sidelined a significant number of owners' efforts. The first step is to recognize this and then to refocus efforts on delegation.

Here are 3 key areas to get started on consistently executing to improve delegation:

- Take at least one team member along on all client meetings so the business owner is not the sole face or contact for clients. This can take a conscious effort but is worth it in the long run.

- Stop solving problems for management. Define, document and train employees on company processes. Then when they come to the business owner with a problem, the owner can inquire how they might solve it themselves, expressing confidence that they can do so themselves.

- If the same problem keeps coming up it’s typically an indication that a system or process needs attention. A recurring issue typically means a process needs defining and/or documentation. Is this an opportunity to implement or update the process? Is it an automation issue? Is employee training needed?

We are here to support business owners and business advisors in topics of ownership transition and business valuation, such as delegation. Please reach out with questions!

Cathy J. Durham, ASA, MBA Business Valuation Analyst Litigation Expert Shareholder cdurham@capvalgroup.com (608) 257-2757 |

Scott Luedke, CPA, ABV, ASA Business Valuation Analyst Litigation Expert Shareholder sluedke@capvalgroup.com (920) 452-8250 |

Jane Tereba, CPA, ASA Candidate Business Valuation Analyst Litigation Expert Shareholder jtereba@capvalgroup.com (608) 257-2757 |

David B. Mitten, MBA Business Valuation Analyst Shareholder dmitten@capvalgroup.com (608) 257-2757 |