If you want to know the value of your home it makes perfect sense to look at recent comparable sales of other homes in your market. After all, this information is publicly available and provides a great deal of detail enabling you to find prior sales that are truly comparable. A quick internet search allows you to dial in to location, number of bedrooms, bathrooms, garage spaces, school district, finishes, mechanicals, to name just a few. Real estate appraisers call this the Market Approach.

When valuing a company, a business appraiser also has access to market transaction databases for businesses; however, the “data” is far less detailed and assumes if the business is in the same industry, it must be comparable. The market approach then takes an average of these transactions to arrive at a multiple of sales and a multiple of earnings. This approach is purely quantitative, with little to no attention paid to how the businesses are actually similar or differ from each other.

A reliable business valuation does consider this Market Approach as one input, but uses the result as more of a test of reasonableness to the conclusion reached from applying what is called the Income Approach. The Income Approach is the favored approach among accredited business appraisers of closely held businesses because it models the quantitative and qualitative components of the subject company’s future business plan and recognizes that every business, even those in the same industry, can be very different from one another.

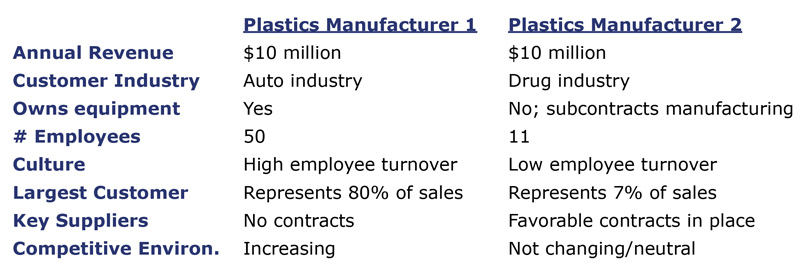

For illustrative purposes, let’s consider two manufacturers in the plastics industry with just a few characteristics that certainly matter to a buyer. Both businesses have the industry NAICS code of 3261X. While the market data allows for adjusting for revenue size differences, it otherwise assumes they are identical. Are they?

As you can see, while these two businesses certainly fall into the same NAICS industry code, there is reason to believe that Plastics Manufacturer 2 is more valuable than Plastics Manufacturer 1, yet the Market Approach would value them equally. The Income Approach would not--it would capture these, and other, qualitative differences in the valuation process.

In summary, when thinking about the value of a business the key is to make sure the valuation includes all the factors that impact value, not just a few gleaned from the income statement. And while at the publicly traded company level, one company may be quite similar to another (think Pepsi and Coca Cola), that assumption just does not work at the privately held business level. If we’ve learned one thing in our 45+ years of valuing thousands of private businesses, it is that once you’ve valued one company, you’ve valued one company! Each deserves the level of attention needed to peel back the layers like an onion to understand the story behind the numbers of that unique business.

We’re happy to answer any of your questions, discuss your client’s business situation or explain these valuation approaches and concepts in more detail any time--just give us a call or drop us a note. If you or your client is planning ahead for an exit, let us know and we can set up a strategy call to talk through the next steps needed to do so with success.

Cathy is the President of Capital Valuation Group, Inc., headquartered in Madison, WI. Capital Valuation Group has been helping business owners across the country understand, increase and unlock the value of their businesses for over 40 years through keynote speaking, valuation analysis, determining damages and providing expert witness testimony. Cathy welcomes conference and event speaking inquiries and can be reached at cdurham@capvalgroup.com.