Nobody would argue 2020 has been an interesting year, but out of challenge can come opportunity. As we look back on the year, we thought it would be a good time...

The Story Behind the Numbers.

Value Added Ideas For Business Owners and Their Advisors.

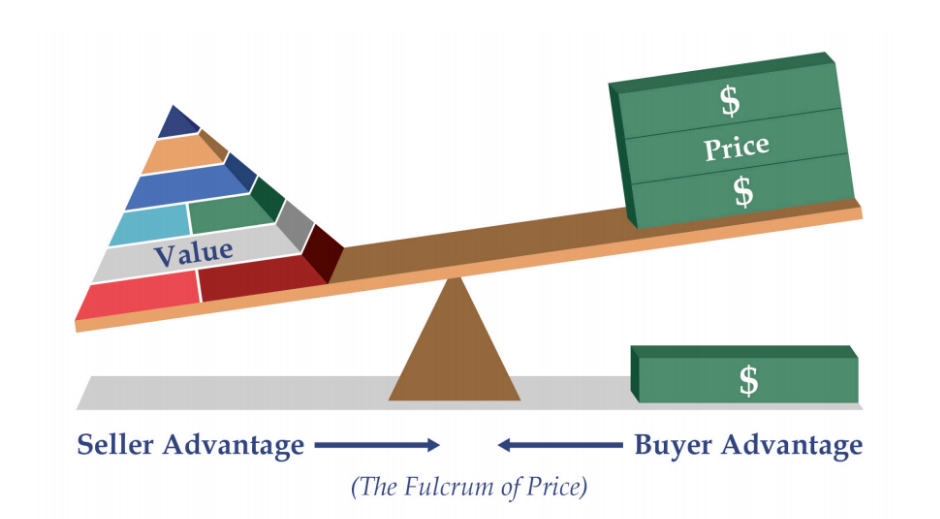

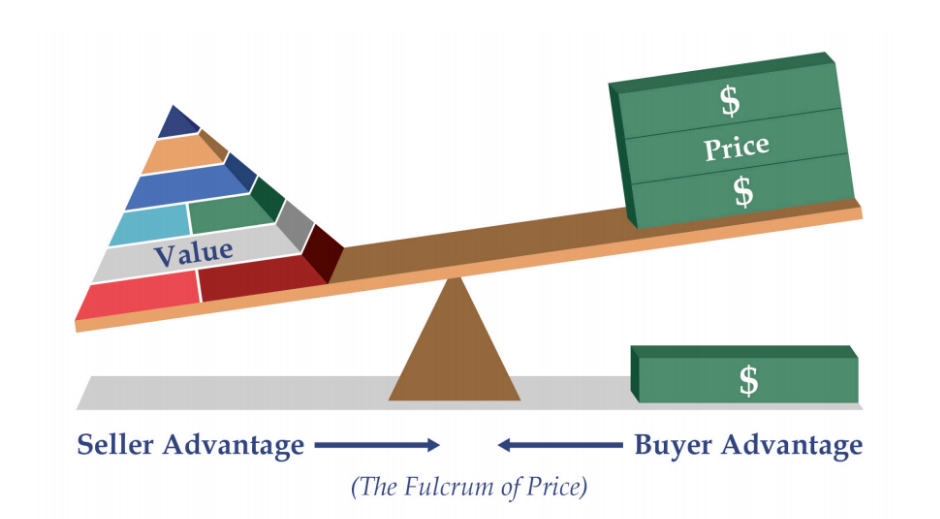

The Psychology of the Deal…Value Doesn’t Always Equal Price

Bargaining Position Matters. While they are frequently confused as being synonymous in the business world, the terms “value” and “price” don’t mean the same thing when...

Meet David Mitten, the Newest Addition to Our Growing Team at Capital Valuation Group

David has joined the CapVal team as a Business Valuation Analyst, and with 12 years of experience doing financial analysis and business modeling, he has hit the ground...

Why Market Comps Drive Home Appraisals, Not So Much for Businesses

If you want to know the value of your home it makes perfect sense to look at recent comparable sales of other homes in your market. After all, this information is...

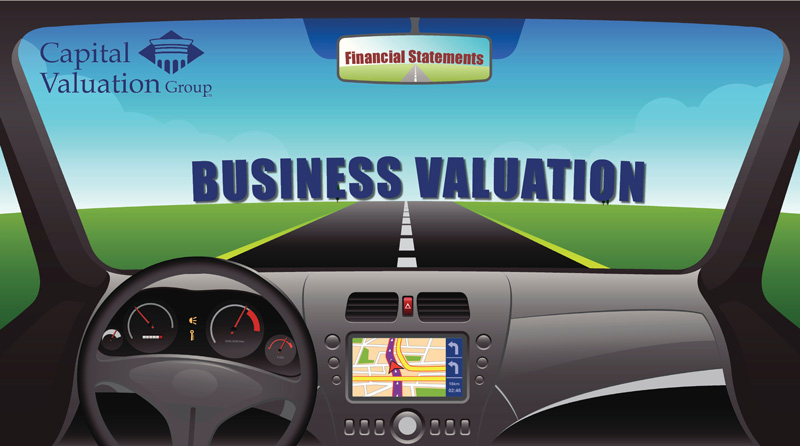

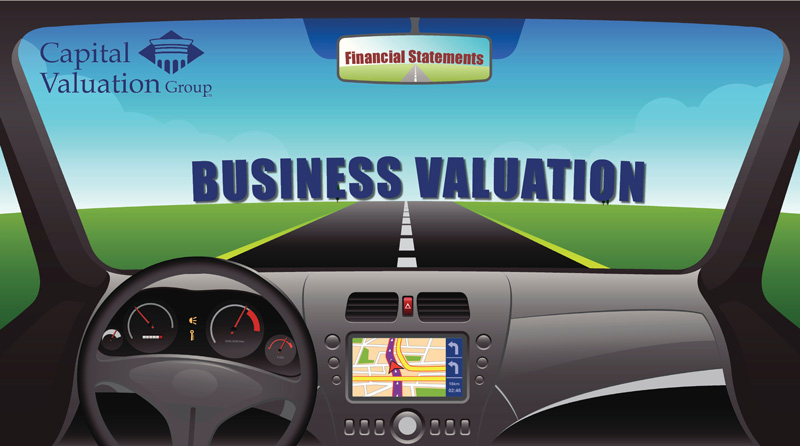

Looking at Your Business Like a Buyer

Can you imagine driving your car by relying on your rearview mirror instead of your windshield? It would be hard to keep driving in the right direction. If we relate that...

There’s Value in the Process, Not Just the Conclusion

“It’s the business valuation process that’s a large part of the benefit, not just the actual conclusion of value. I learned a lot about my own business by going through the...

3 Reasons to Talk Business Valuation with Your Clients

We talk a lot about the ins and outs of business valuation and thought it might be helpful to take a step back to share three quick, but important, reminders you can share...

Quantitative Value Drivers

It can be tempting for business owners to focus on short-term gains versus taking the long-term view. However, the company is likely a business owner’s most valuable asset so it’s worthwhile knowing the drivers of value today so they can start to understand how every decision they make today impacts the future. Whether they want to sell in 1 year or 5+ years, the sooner they start the better because increasing value does not happen overnight.

TIME to Drive Business Value (Part 2)

Business valuation includes considering both quantitative performance and qualitative factors. Last month we suggested five qualitative drivers of business value to work on...

TIME to Drive Business Value

Last month we talked about finding opportunity in times of crisis, such as COVID-19. Before this pandemic struck, most business owners would admit it was difficult to...

Time to Review These 10 Value Driving Activities

Nobody would argue 2020 has been an interesting year, but out of challenge can come opportunity. As we look back on the year, we thought it would be a good time...

The Psychology of the Deal…Value Doesn’t Always Equal Price

Bargaining Position Matters. While they are frequently confused as being synonymous in the business world, the terms “value” and “price” don’t mean the same thing when...

Meet David Mitten, the Newest Addition to Our Growing Team at Capital Valuation Group

David has joined the CapVal team as a Business Valuation Analyst, and with 12 years of experience doing financial analysis and business modeling, he has hit the ground...

Why Market Comps Drive Home Appraisals, Not So Much for Businesses

If you want to know the value of your home it makes perfect sense to look at recent comparable sales of other homes in your market. After all, this information is...

Looking at Your Business Like a Buyer

Can you imagine driving your car by relying on your rearview mirror instead of your windshield? It would be hard to keep driving in the right direction. If we relate that...

There’s Value in the Process, Not Just the Conclusion

“It’s the business valuation process that’s a large part of the benefit, not just the actual conclusion of value. I learned a lot about my own business by going through the...

3 Reasons to Talk Business Valuation with Your Clients

We talk a lot about the ins and outs of business valuation and thought it might be helpful to take a step back to share three quick, but important, reminders you can share...

Quantitative Value Drivers

It can be tempting for business owners to focus on short-term gains versus taking the long-term view. However, the company is likely a business owner’s most valuable asset so it’s worthwhile knowing the drivers of value today so they can start to understand how every decision they make today impacts the future. Whether they want to sell in 1 year or 5+ years, the sooner they start the better because increasing value does not happen overnight.

TIME to Drive Business Value (Part 2)

Business valuation includes considering both quantitative performance and qualitative factors. Last month we suggested five qualitative drivers of business value to work on...

TIME to Drive Business Value

Last month we talked about finding opportunity in times of crisis, such as COVID-19. Before this pandemic struck, most business owners would admit it was difficult to...