Article 2: How to Choose the Right Financial Expert for Your Case

Welcome back to our series on how to benefit from working with a financial expert in business litigation. If you missed the last article discussing the “WHEN” of hiring an expert, you can find it here. This time, we’re diving into choosing WHO to hire as your financial expert.

A strong expert can have a significant impact on damages awards, so it’s important to hire the best expert available. Choosing the right expert for your case centers on evaluating their credentials, credibility, independence, relevant experience, and communication skills. Let’s walk through how to navigate this choice.

Credentials and Certifications

An experienced, capable expert should have knowledge and expertise that they use consistently to stay intellectually current.

Expert Resources and Certifications Related to Business Damages and Tracing

- SEAK—The Expert Witness Training Company provides rigorous education for experts in determining damages, report writing, and providing testimony.

- Certified Fraud Examiner – must have 2 years of fraud-related experience and pass a 4 part exam. Additionally, 20 hours of continuing education annually, 10 hours of which must relate directly to the detection and deterrence of fraud, and 2 hours must relate directly to ethics.

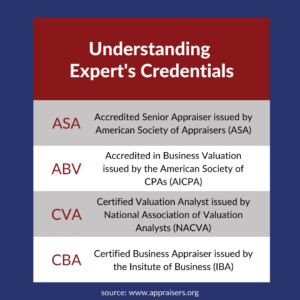

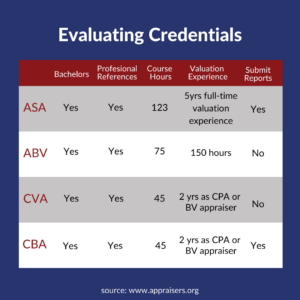

- Business Valuation Experts – there are a number of business valuation credentials, of which the ASA is the most rigorous. The tables below provide information about the designations and requirements for earning each credential.

Credibility

In mediation, arbitration or the courtroom, an expert is selling their credibility to the judge and/or jury. Regardless of intelligence or experience, without credibility and the ability to communicate, their credentials won’t matter. The expert should have a sound reputation personally, professionally and in court.

Related to credibility, integrity defines an expert’s character. Will the report be a true reflection of their analyses and independent opinions? Can they support their assumptions with research, surveys, prior testimony and interviews? Do they do the work to build a credible argument as to why their opinion is both logical and well-supported, or do they just crunch numbers and ask that their judgment be relied upon?

Independence

Every damages or valuation expert considers themselves “independent;” however, the courts would not agree. There can be an inherent conflict of interest if the expert’s firm does other work for the client’s business. An expert, or the expert’s firm, should not depend on the client for any other revenue stream.

For example, if the expert’s firm also does accounting, tax preparation or consulting work for the client, the expert could be motivated (or appear to be motivated) to keep the business owner happy by drawing conclusions that benefit the business. Is the expert actually acting independently in making valuation or damages assumptions?

A good rule of thumb is that the attorney is an advocate, the expert is not. While it’s okay to work together and become friendly, experts should never appear to be part of an advocacy team.

Likewise, experts should not manipulate or limit source data or conclusions to provide the attorney or client with the conclusion they want to hear. Tailored or one-sided opinions can lead to big problems on cross-examination.

Another consideration is how many times the expert has worked for the same attorney. Repeat work is okay, but the perception of advocacy is not.

If an attorney has worked many times with the same damages expert, it could appear to the trier of fact that the expert is on the attorney’s “side” and just providing answers they want to hear vs. acting independently. This can be used against the expert on the witness stand; however, an experienced expert can address this question professionally.

Relevant Experience

An expert must be skilled in damages and/or valuation, pretrial preparation, and being examined or cross-examined.

An experienced financial expert will be adept at anticipating areas of attack from the other side critiquing the analysis and report. They will be prepared with documents to support their conclusions, making them a stronger witness for your case.

Ask a potential expert if they have experience providing testimony at the state and federal level. Are they a novice or experienced witness? How have they communicated complex concepts to juries and judges in the past? What percentage of their work involves litigation support?

Communication Skills and Demeanor

An expert’s communication and presentation skills are as important as their professional credentials. Someone with excellent communication skills can impress a judge/jury more than someone with impressive credentials who struggles to communicate effectively.

Presence and “jury appeal” are among the most valuable traits an expert can have. Evaluate if your potential expert is able to:

- Engage the judge and/or jury

- Stay cool under attack

- Stay focused

- Think flexibly

Financial analysis can be complex. Can the expert communicate like a good “teacher” to help the attorney and the judge/jury understand the materials and terminology? Will the expert be able to explain difficult concepts in easy-to-understand terms, breaking down complex subjects?

An effective expert needs to maintain good eye contact, speak in a confident voice and have an unflappable demeanor. They need to accomplish this without coming across as arrogant or seemingly talking down to the judge/jury. The key is an expert who can teach, not preach.

Matching Your Expert

As an attorney, matching your expert to your case is critical. Consider whether it will be a jury or a bench trial. Are damages likely to be technical and detailed? Is it accounting intensive, business operations intensive or forensic tracing intensive? These details inform your choice of experts.

Choose an expert who can change their communication style depending upon who they are talking to and the level of detail that is required. Sometimes the expert may need to speak like a teacher to a jury with vastly different educational backgrounds, while other cases may require a CPA-level conversation with a judge.

We’re Here to Help

Hiring the right financial expert can have a significant impact on your case. Let us know if you have further questions about how to evaluate the credibility, experience and communication skills of a financial expert.

Based on our firm’s more than 45 years of experience focused entirely on valuing businesses and determining damages in business litigation, we can provide insight, experiences and ideas for ways to approach the financial portion of your litigation project that you may not have encountered yet.

Stay tuned to your inbox and follow Capital Valuation Group on LinkedIn as we share more from this series on how to successfully navigate each phase of the litigation process. If you have a particular situation you would like to discuss, give us a call. We are happy to have a complimentary initial discussion.

Would you or other people in your firm find value in this series? Subscribe to our email list here.

Cathy Durham is a principal of Capital Valuation Group, Inc., headquartered in Madison, WI. Capital Valuation Group has been helping business owners across the country understand, increase and unlock the value of their businesses for over 45 years through keynote speaking, valuation analysis, determining damages and providing expert witness testimony. Cathy welcomes conference and event speaking inquiries and can be reached at cdurham@capvalgroup.com. Phone 608-257-2757