Dear Cathy,

I am the owner of a car dealership with 2 locations, and I find it stressful that I can’t answer the simple question “what is my business worth?” I need to know this as I plan for location expansion and insurance purposes. Frankly, I have hesitated to reach out to someone because unlike most areas of business I don’t have a good understanding of business valuation and I don’t know who to trust to help me understand these concepts.

I heard you speak recently and hoped you would be willing to talk with me.

Sincerely,

Russell

Dear Russell,

You are not alone—in fact, you are further along than you think since you have this topic on your radar to help inform your current business operations, not to mention the future.

As I mentioned during my talk, it’s important for business owners to understand the value of their business, since it is generally their most valuable asset. I often say you would never let your 401k go unchecked for 10 years and assume the balance is growing. Likewise, you should not spend years working in your business and ignore the ways to increase value.

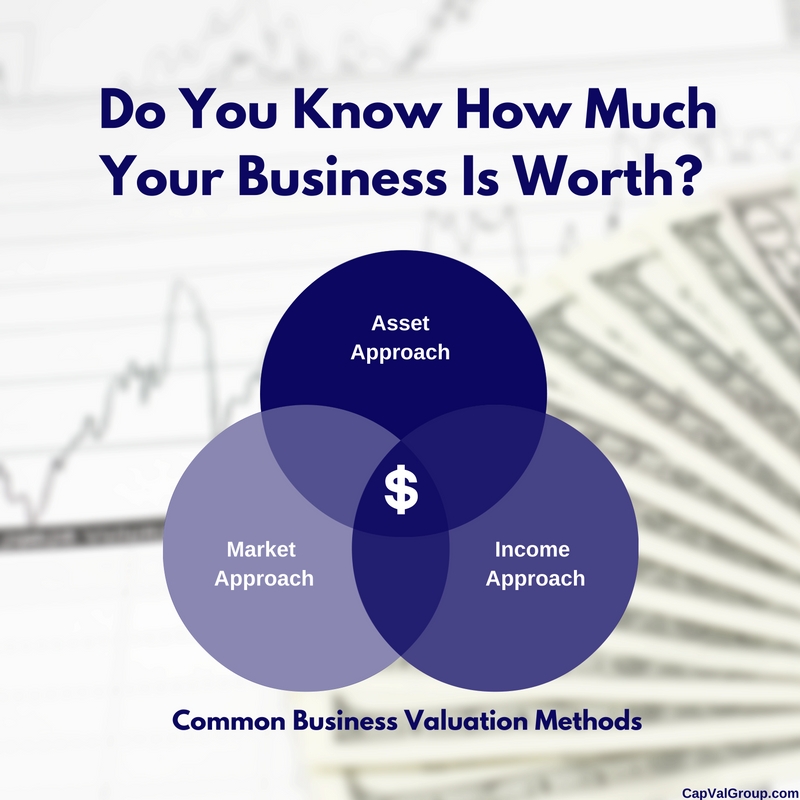

So how do we value a business? Despite what you may hear, business valuation goes far beyond a multiple of revenues or earnings. In fact, experienced business appraisers apply several different approaches and methodologies based on the specific business being valued.

The following methods are broadly accepted valuation methods that can help estimate what your business might be worth.

Asset Approach

The asset approach derives a value by adjusting the company’s assets and liabilities from their reported book value (valued at original cost) to their estimated fair market value. This approach reflects an orderly liquidation and does not consider the business’s future earning capacity. This approach assumes the business is worth more in liquidation than as a going concern, which is rarely the case.

This method is most appropriate for holding companies, such as companies owning real estate, capital intensive companies and companies that do not possess good will value.

Market Approach

The market approach is based on the concept of substitution. Transactions from publicly traded companies, closely held comparable companies and prior arms-length transactions of the subject company‘s equity provide the appraiser with earnings multiples to apply to the subject company to arrive at an indication of value (notice I did not say arrive at a conclusion of value, this multiple is just one piece of the story!) This method is frequently used as a “reasonableness test” to the income approach.

Income Approach

The income approach projects future earnings streams and discounts these streams to their present value using a cost of capital reflective of a typical investor’s required rate of return. There are two methods used under the Income Approach – Capitalization of Historical Earnings Method and the Discounted Cash Flow Method.

The Capitalization of Historical Earnings method requires you to estimate a normalized cash flow, which is adjusted for revenue or expenses that are out of the ordinary or not at market levels, and divide into that figure a capitalization rate to estimate the value of the business. This method is only to be used when the company’s future is expected to look very similar to the recent past financial performance. Therefore, this method applies to very few closely held businesses.

The Discounted Cash Flow Method develops multi-year detailed projections of revenues, expenses and cash flows that are discounted at a cost of capital that accounts for the risks and opportunities inherent in the business. The present value of the cash flows is then calculated, plus a residual value, to arrive at an estimate of the value of the business. Discounts for the lack of marketability and premiums for control are then determined and applied.

We consider all three of these approaches when helping answer “what is my business worth,” although not all are weighted equally in the final valuation conclusion. It is important that these valuation approaches include consideration of ALL factors that would increase or decrease the value of your business, not just the financial results of the company.

An experienced valuation expert will happily educate you on these topics. If someone can’t or won’t explain these topics it should raise a red flag. I would welcome the opportunity to talk with you further!

Kind Regards,

Cathy Durham